Budgeting is an essential component of personal financial management. It enables people to take control of their finances and plan for the future. Budgeting has become easier than ever in today’s environment due to the abundance of budgeting apps accessible. With so many alternatives to choose from, it might be difficult to select the best one. This article will assist you in selecting the best budgeting apps for your personal financial management requirements.

What is Budgeting?

Budgeting is the practice of allocating your income to various costs such as housing, food, entertainment, and savings. It assists you in keeping track of your expenditures and identifying places where you may save money. This allows you to save money and eliminate debt while living within your means. The budgeting apps listed above include both free and paid solutions, each with its own set of features and functions. Mint, for example, provides extensive budgeting and personal money management capabilities such as cost monitoring, bill reminders, and investment tracking.

10 Best Budgeting Apps For 2023

1. Mint

Mint, a pioneering budget tool, is still widely used today. Mint, a subsidiary of Intuit, which also owns TurboTax and QuickBooks, offers extensive budgeting tools. The software is completely free to download and use. There is also a Canadian version of the program available. “I have used mint for many years,” says Amore Philip, CEO of Apples & Oranges Public Relations. “It is, hands down, the best financial tool I have used to manage my household finances.” It was also Philip’s pick as a user-friendly tool while assisting her 18-year-old daughter with budgeting. Mint users may link to and manage accounts from numerous financial institutions. Furthermore, the software categorizes expenditures and generates a recommended budget that may be altered. It also offers free credit ratings, tracks investments, sends alerts when transactions post to an account, and offers personalized money-management advice.

The free version of the app contains advertisements, but for $4.99 a month, users can upgrade to Mint Premium, which provides an ad-free experience as well as extra conveniences such as a subscription cancellation service. While Mint is accessible for both Apple and Android devices, Mint Premium is currently only available for iOS.

Quicken has long been one of the most well-known names in budgeting apps, and the firm now offers a mobile app for consumers seeking a more simplified budgeting solution. People may use the Simplifi app to link and sync an infinite number of bank, credit card, loan, and investment accounts from over 14,000 financial institutions. The software can recognize routine bills and offer a customized spending strategy.

Users may create a watch list to track certain types of expenditure, such as dining out, and receive notifications when their spending hits a specified threshold. Simplifi by Quicken is ad-free, and customers pay a monthly fee of $3.99, which is invoiced annually at $47.88. It is accessible via the web as well as the mobile app. Promotions are occasionally available to reduce the price, and the app comes with a 30-day money-back guarantee.

3. Empower

Empower, formerly Personal Capital, differentiates itself from other budgeting apps by integrating a wealth management component. For budgeting, measuring net worth, and monitoring portfolio performance, the app may be linked to a number of bank institutions. Its free budget planner allows users to construct a thorough plan and quickly make changes as needed. You can also establish savings goals and track your net worth in real time using the app. Empower is a free budget program that can be downloaded and used. Some services, such as specialized investment counseling, do have a price.

4. YNAB

Previously known as You Need a Budget, YNAB is both an app and a software tool that can be used to construct zero-based budgets across many platforms. Users may link bank accounts, make budgets, and sync data in real time, making it a great choice for individuals who wish to monitor financial activities in real time. The program may also track objectives and provide financial progress reports. “You Need a Budget is a fantastic service because it allows people to set a budget based on their income and adjust it when unexpected financial circumstances arise,” explains Robert Farrington, creator of The College Investor.

“This app is ideal for college students because they can use the service for a year for free.” Others will find YNAB to be one of the more costly budgeting apps accessible, costing $14.99 per month or $99 per year if paid annually. You may, however, try it for free for the first 34 days. The YNAB website also provides budgeting resources such as forums, podcasts, and videos to assist consumers in creating and sticking to a budget.

5. Goodbudget

6. BusyKid

If you wish to expose your children to the notion of budgeting, BusyKid can help. The software allows children to log tasks, and when parents give an allowance, money is automatically assigned to the categories of saving, spending, and sharing. “Everything we do here at BusyKid is to prepare kids for the financial realities of the world,” says Gregg Murset, CEO of BusyKid and a qualified financial advisor. This includes connecting money to effort, such as housework, and giving youngsters a debit card to use for spending money.

Children may use the app to browse stocks and organizations for saving and sharing money, but parents have the ultimate say on how those funds are used. Children decide how to spend the money they have been given, but parents may monitor their purchases. Murset promotes this so that families may have discussions about sensible spending practices. BusyKid charges $48 per year for up to five children and offers a 30-day money-back guarantee. The FDIC insures funds kept in BusyKid accounts.

7. PocketGuard

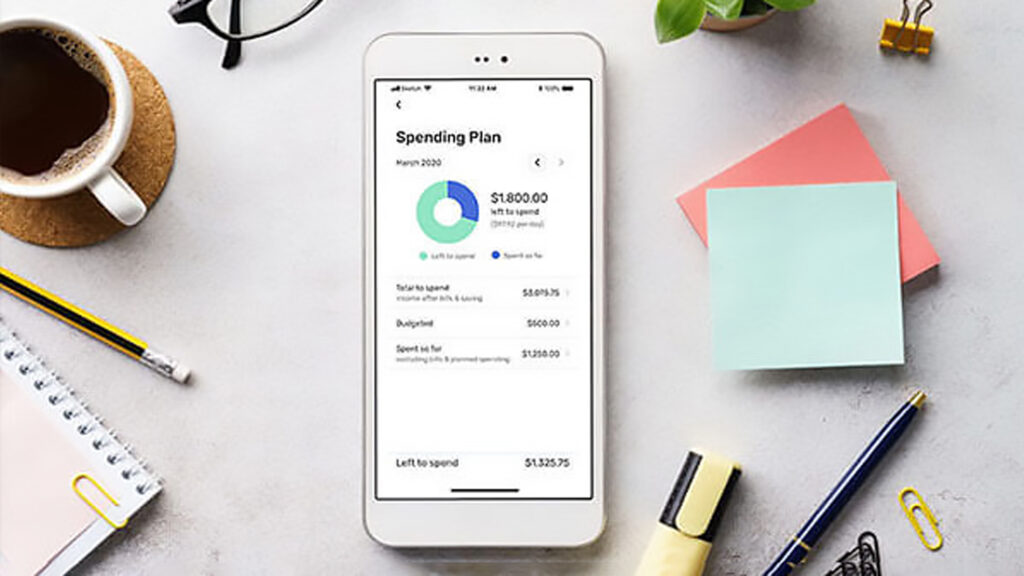

PocketGuard’s design is clear and simple, allowing you to instantly see where your money is going and how much is available to spend. “For those looking for a simple and easy-to-use budgeting app, PocketGuard is a great option,” says Boris Dorfman, founder of the LBC Capital Income Fund, a private lender for real estate investors. He mentions that the program enables users to connect their bank accounts, make budgets, and track their spending in real time. It will also provide notifications when they are approaching or over their budget, making it simple to stay on target. PocketGuard categorizes spending and estimates how much is left after bills are paid, making it an easy method to automatically construct a budget.

You may also specify savings objectives, and PocketGuard will deduct and track contributions toward those goals automatically. PocketGuard’s basic version is free to use, but PocketGuard Plus charges $7.99 per month or $34.99 per year. A one-time lifetime purchase of $79.99 is also available. Additional capabilities, such as customization choices and the ability to divide transactions across categories, are available in the premium edition.

8. Honeydue

Honeydue enables couples to connect their bank accounts, create shared budgets, and track each other’s spending. “For couples looking to manage their finances together, Honeydue is an exceptional app,” Dorfman explains. “In addition, Honeydue includes a chat feature for communicating about finances, making it simple for couples to stay on the same financial page.”

Honeydue can access accounts from over 20,000 financial institutions across five countries. It will also provide you with notifications about impending invoices. Users may create a shared bank account using Honeydue, which is not necessary to utilize the service. The Honeydue app and its associated bank account are both free to use; however, you may encounter some in-app advertising.

9. Monarch

Check out Monarch if you want additional control over your app’s dashboard and appearance. This software allows users to customize their desktop and phone dashboards for free by rearranging widgets and turning off those they don’t want to view. “It has great tracking and banking connectivity features,” explains Farrington. “It also includes unlimited spending category customization and digestible visuals to help people understand how they spend their money.”

Monarch will track your net worth, schedule recurring expenses, and let you experiment with alternative budget scenarios to see how they will affect your financial future. It also facilitates collaboration and information sharing with a partner, whether that person is a spouse or a financial advisor. Monarch is available for free for seven days. Following that, it will cost $14.99 per month or $99.99 per year if purchased annually.

10. Your Banking App

Some individuals prefer to use many best budgeting apps, but if you’re a digital minimalist, the best budget app may already be on your phone. Check to see whether your existing banking app has budgeting options before downloading something new.

The Chase Mobile app, for example, has a spending and budgeting function. It offers in-depth, customized views that help you track what you’ve bought to prevent overspending and help you stay on budget,” says Sonali Divilek, JPMorgan Chase’s head of digital products and channels. It also offers a snapshot option that delivers automated daily insights that highlight the most expensive categories. Other banks may offer comparable powerful features that can assist you in analyzing expenditures, developing a budget, and tracking purchases by category.

Conclusion

There is no such thing as the best budgeting apps for everyone. It is critical to select a budgeting tool that suits your specific needs and interests. When choosing budgeting software, consider considerations such as the functionality you require, the user experience, and the pricing. Before making a selection, consider reading reviews and comparing numerous possibilities. You can take charge of your finances and achieve your financial goals with the appropriate budgeting app.